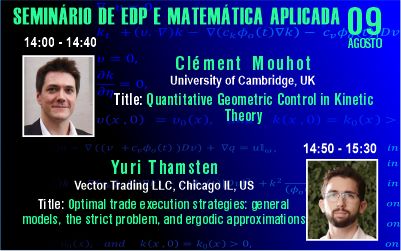

Seminar in EDP and Applied Mathematics

August 9th, 2023 – 14h (Brazil)

Streaming: Youtube Channel | SEMINARIO DE EDP E MATEMATICA APLICADA

Event

About Seminars

Our Online Seminar is one of the most important events in Brazil, it has been held since August 2020, every Wednesday at 2 pm, Brasília time, with a frequency of 14 days. Two 40-minute lectures are presented in each session. Our speakers are world-renowned mathematicians from Europe, the United States and South America.

Featured Talks & Speakers

Clément Mouhot

University of Cambridge, UK

14:00h – 14:40h

Quantitative Geometric Control in Kinetic Theory

Yuri Thamsten

Vector Trading LLC, Chicago IL, US

14:50h – 15:30h

Optimal trade execution strategies: general models, the strict

problem, and ergodic approximations.

We present a model for optimal execution in which both volatility and liquidity are stochastic.

Our assumption is that a multi-dimensional Markov diffusion drives these processes. In our model, the market is frictional. Particularly, the trader incurs a instantaneous price impact.In this connection, we consider concave-shaped or linear limit order books.

In the regularized setting, meaning we do not necessarily enforce strict execution, we characterize the value function as the unique continuous viscosity solution to the corresponding HJB. We provide this result using appropriate an monotonicity and fixed point arguments.From our method, an iterative numerical algorithm follows for approximating the regularized solution. Then, further proceeding with the monotonicity arguments, we obtain the solution of the optimal strict execution problem as a (singular) limit of its regularized counterparts.Particularly, we guarantee a good numerical approximation for the strict execution problem —

to our knowledge, for the first time in the literature.

Subsequently, we specialize the Markov diffusion to be a fast mean-reverting one. We assess this

hypothesis by using high-frequency financial data. We provide a novel bagging methodology for

estimating the random liquidity model parameters, and also employ noise-robust methods for

estimating the stochastic volatility. Working under this ergodic framework, we derive a leadingorder approximation for the optimal solutions we studied before, and also get a first-order

correction. We provide numerical illustrations and accuracy results for our approximations.

About Organization

Juan Limaco – UFF – Brazil (Coordenador);

Mauro Rincon – UFRJ – Brazil

Max Souza – UFF – Brazil;

Sandra Malta – LNCC – Brazil

Marcelo Cavalcanti – UEM – Brazil;

Rui Almeida – UBI – Portugal

Roxana Lopez – UNMSM – Peru;

Diego Souza – U Sevilla – España;

Mauricio Sepulveda – UdeC – Chile;

Roberto Capistrano – UFPE – Brazil.

Our Partners

Access our channel!

A channel for students, professors, researchers and professionals who wish to deepen their knowledge in EDP and applied mathematics.